TellDunkin Survey is the official DunkinRunsOnYou Survey Portal where customers can give their feedback, opinions, thus giving an opportunity to Dunkin’ Donuts to improve their services. The survey can be easily accessed online at the official website www.telldunkin.com. On successful completion of the TellDunkin Survey, you will be provided with the gift coupon that can be availed on your next visit.

The main objective of this Dunkin’ Donuts Guest Experience Survey is to receive honest comments from the customers. Dunkin’ Donuts value your comments a lot, and they strive to enhance the customer satisfaction level on their premises.

The questionnaire of the TellDunkin’Survey includes questions related to food quality, services, recommendations, suggestions, complaints, repetition of your visits, etc.

What do I require to participate in the TellDunkin Survey?

Kindly, have a look at some of the prerequisites for the TellDunkin Survey:

- You will need a computer, laptop or a mobile phone having an active internet connection

- Please make sure that the internet connection is stable

- You must have basic knowledge of the English language to participate in the Tell Dunkin Survey.

- You must have a valid proof of purchase for the Dunkin Donuts restaurant. It contains a Tell Dunkin Survey code.

- Your age should be greater than 18 years to participate in the TellDunkin Survey.

| Official Name | TellDunkin |

|---|---|

| Country | United States |

| Purpose | Survey |

| Rewards | Free food |

| Speciality | Donuts |

How do I participate in the DunkinRunsOnYou Survey?

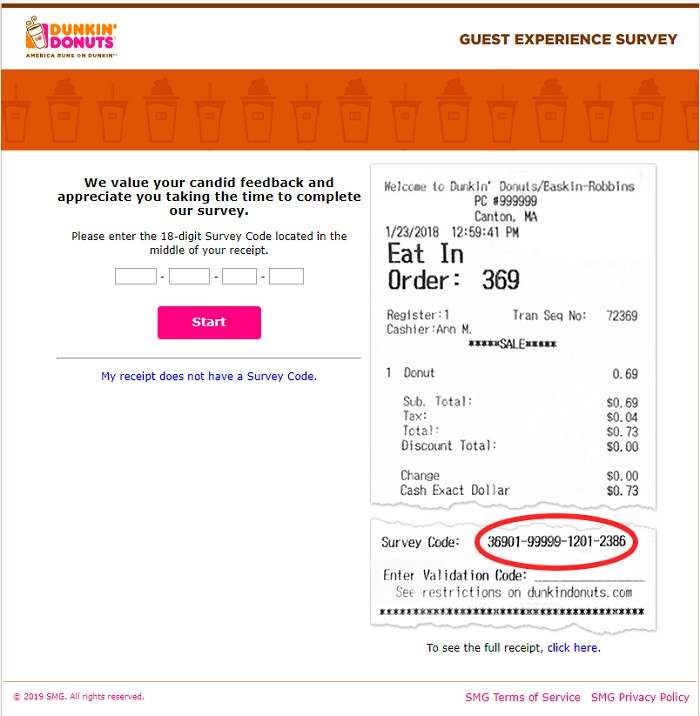

You must have a purchase receipt of your last visit to the Dunkin’ Donuts. This purchase receipt contains a Tell Dunkin Survey code.

Have a look at some of the steps you need to follow at www.telldunkin.com:

- First of all, visit the official website at www.telldunkin.com

- Select the desired language from either English or Spanish

- Input the 18-digit survey code and tap the “Submit” button

- Kindly be honest while answering the questions asked in the TellDunkin Survey

- On successful completion of the Dunkin’ Donuts Survey, you will receive a validation code. Kindly, redeem this code on your next visit to the Dunkin’ Donuts store

Please, answer those questions honestly.

On successful completion of the TellDunkin/DunkinRunsOnYou Survey, a validation code will be displayed on the screen.

You will be asked to write this code on a sheet of paper or if it is convenient for you.

Don’t forget to take this Tell Dunkin Survey code on your next visit to the Dunkin’ Donuts.

Rules and Regulations participate in the survey at TellDunkin.com

- The survey receipt that contains TellDunkin survey code needs to be redeemed within 30 days of the survey

- A customer is allowed to issue only one TellDunkin Survey receipt

- This coupon code is not transferable

- TellDunkin offers cannot be combined with any other offers or rewards

- In case, you are the lucky winner all the taxes included has to be compensated by the customers

Main concerns behind TellDunkin Survey

- To know about the client’s opinion on the food, cleanliness, staff behavior, etc.

- To know the customer’s experience and satisfaction with Dunkin’ Donuts. TellDunkin is a great help for the same.

- To know about the customer’s last experience on their visit to Dunkin’ Donuts.

- TellDunkin Survey helps customers to know their point of view, in terms of their food, drinks, staff behavior, etc.

- With the help of the TellDunkin/DunkinRunsOnYou Survey, administrators know about their stores, employees, etc. They also know and analyze their services, and improve them if needed.

- For more details about TellDunkin Survey, you can visit their official stores.

How do I contact Dunkin’ Donuts?

Official website – www.telldunkindonuts.com

Survey page- TellDunkin.com

Customer contact number: 800-859-5339

Contact email: [email protected]

Working hours: Monday to Friday from 8:30 a.m. to 5:00 p.m.

Rewards for TellDunkin Survey also known as DunkinRunsOnYou

On successful completion of the TellDunkin Survey, you will receive some lucrative rewards like:

- You will receive a coupon code that makes you eligible for a free donut ice cream, from which you can buy a medium or large drink.

- You also have the opportunity to participate in the sweepstakes. It will enable you to get heavy discounts and some free coffee the entire year.

About DunkinRunsOnYou

Dunkin’ Donuts is a multinational coffee chain based in the United States. It specializes in drinks and donuts. It is headquartered in Massachusetts, US. Dunkin ‘Donuts serves a wide range of foods such as salads, cookies, pizzas (in some countries), etc. Dunkin’ Donuts is well-known for its high-quality donuts.

Dunkin ‘(known as Dunkin’ Donuts from 1950 until the beginning of 2019 and still known as such in public) is a US coffee and fast-food multinational. It was established in 1950 by William Rosenberg in Quincy, Massachusetts.

Dunkin’ Donuts started its journey in 1990. Allied Domecq was the one to start with. The acquisition of the Mister Donut chain and the transformation of this chain in Dunkin ‘Donuts has allowed the brand to develop in North America this year. TellDunkin Survey is a small effort to be the best not only in the US but also all over the world.

We hope this article has helped you to participate in the TellDunkin/DunkinRunsOnYou Survey. This article covers a variety of topics, including participation in surveys, survey objectives, survey details, rewards, and more.

We hope you are now clear with the TellDunkin’ Survey. In case of any queries, you can post the same in the comment section without any hesitation.